in Port News 18/02/2020

New Zealand’s ports have generally continued to experience growth in container volumes amid potential that all freight operations at the Ports of Auckland could eventually get dispersed amongst other nearby ports.

Ports of Auckland plays a huge role in New Zealand’s trade with other countries, being that it handles the second highest amount of container volumes in New Zealand, with the Port of Tauranga taking first place. However, the Ports of Auckland did experience year-over-year declines in net profit and container volumes for fiscal year 2019, which ended June 30, 2019 for New Zealand’s ports.

From port to port. New Zealand’s ports collectively handled 3.43 million TEUs in FY 2019, up 1.3% from FY 2018 and up 7.4% from two years prior, as illustrated in the chart below, which was built using data from the relevant port authorities across the country.

Six of the ports saw container volumes increase year-over-year in FY 2019, while three experienced a decline, as illustrated in the chart below, which was also built using port authority data.

The chart below, built using data from BlueWater Reporting’s Port Dashboard tool, shows the Port of Tauranga is called by the most liner services that connect New Zealand to regions beyond Oceania at 13, nine of which are container services, followed by the Ports of Auckland with 11 liner services, six of which are container services.

The Ports of Auckland and the Port of Tauranga have the strongest global ties of New Zealand’s ports. While the vast majority of the liner services that call New Zealand don’t sail beyond Oceania or Asia, there are four liner services that call New Zealand that sail beyond these two regions.

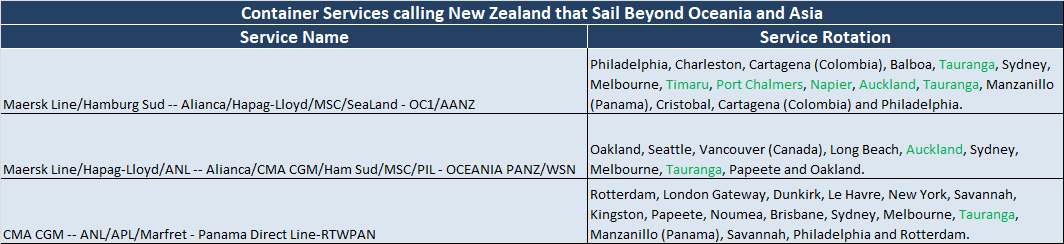

The chart below, built using data from BlueWater Reporting’s Port Dashboard tool, shows the three container services calling New Zealand that also sail beyond just Oceania and Asia. All three call the Port of Tauranga, while two of the three call the Ports of Auckland.

Not included in this chart is a roll-on/roll-off service operated by Wallenius Wilhelmsen. Although the ro-ro service’s rotation changes slightly with each voyage, it tends to sail between North Europe, the East Coast of North America, Central America, Oceania, Asia, West Coast North America, Mexico, Central America, East Coast North America and back to North Europe. The ro-ro service tends to only call Auckland in New Zealand.

Shift proposal. A final report by The Upper North Island Supply Chain Strategy (UNISCS) Working Group, an independent working group that reported to New Zealand’s Ministers of Finance, Transport and Regional Development, found that the Ports of Auckland is unviable long term.

The final report, titled, “Transforming Auckland; Transforming Northland – Final Report of the Upper North Island Supply Chain Strategy (UNISCS) Working Group,” was released in November.

The UNISCS Working Group recommended that Northport, which operates a multi-purpose port in Marsden Point, should be developed to take over much or all of Auckland’s existing and projected freight business, while the Port of Tauranga’s existing expansion plans should proceed to accommodate growth.

“The new two-port configuration should be supported by a rejuvenated North Auckland rail line and spur to Northport, and a new inland freight hub in northwest Auckland to complement and be connected to Metroport (Auckland) in the south,” the UNISCS said.

MetroPort Auckland is an intermodal cargo hub that connects to the Port of Tauranga via rail.

The working group recommended the government give the ports until Dec. 1 of this year to reach a commercial agreement on how the strategy should be implemented. Additionally, the working group recommended the transition begin immediately and be fully implemented by no later than 2034.

The working group said it “argues for Tauranga to continue with its growth plans but for Northport to be the major site to cater for freight growth over the next 15 years and beyond.”

In response to the finding’s, New Zealand’s Ministry of Transport said in December that the working group’s recommendations raise a range of economic, social and environmental questions for the government to consider. Consequently, the government instructed the Ministry of Transport to undertake further analysis and report back to the Cabinet in May.

Time for a shift? There appears to be numerous reasons to shift freight operations from the Ports of Auckland, with one of the largest being the amount of money that would have to be invested into the site for it to remain viable.

The UNISCS Working Group noted how the Ports of Auckland’s freight operations are already constrained, particularly on the landside, adding how it would require an estimated NZ$4 billion in investment over the next 30 years and the dredging of a further two million metric tons from Auckland’s Waitemata Harbor for the port to effectively handle New Zealand’s expected freight growth.

Additionally, existing port operations in Auckland remain highly industrial, and include the importation and storage of containers, vehicles, coal and cement. “These uses produce very poor returns for its owner, Auckland Council, with dividends dropping as low as NZ$8.7 million for the privilege of occupying land with probable value of NZ$6 billion,” the working group added.

Business at the port was not exactly booming in FY 2019. The Ports of Auckland’s annual report for the fiscal year showed that compared to the prior fiscal year, breakbulk cargo volumes (including cars) fell 3.3%, container volumes fell 3.5% and car volumes fell 14.3%.

Ports of Auckland CEO Tony Gibson said container volumes were down because infrastructure work needed to automate the terminal reduced the terminal’s capacity and made operating more difficult. Additionally, he said car volumes were hindered by a drop in car sales, as well as new treatment rules for imported vehicles, which are designed to prevent the brown marmorated stink bug from entering the country.

However, data from Ports of Auckland shows that container volumes for FY 2019 were the lowest they had been since FY 2016, as illustrated in the chart below.

Additionally, Auckland’s economy is no longer based on manufacturing, let alone agricultural commodities, but is overwhelmingly dominated by services, according to the UNISCS Working Group, which added how Auckland generates export revenues from tourism, education and IT, which don’t require a port.

It also appears most Aucklanders don’t necessarily want a port in the area. A June 2019 Colmar Brunton study, dubbed, “Aucklanders’ Sentiment Towards Moving the Auckland Port,” which was prepared for the Ministry of Transport on behalf of the UNISCS Working Group, asked respondents, “How do you think moving the cargo port would affect Auckland’s attractiveness as a place to live, work or visit?” Sixty-two percent of respondents said they thought that moving the cargo port to a new location (possibly outside Auckland) would make Auckland much/slightly better.

Potential prospects. Auckland, Tauranga and Northport make up the Upper North Island’s three ports. While Northport is New Zealand’s newest port with a massive amount of potential, the Port of Tauranga is the country’s biggest port and continues to see rampant growth.

“The progressive and managed closure of Auckland’s freight operations, the development of Northport and the continuation of Tauranga’s existing expansion plans is in the best interests of Auckland, the rest of the Upper North Island and New Zealand as a whole,” according to the UNISCS Working Group.

In regards to Northport, the working group noted how there is a vast supply of flat, industrial-zoned land adjacent to the port with no higher alternative uses. “The storage of imported vehicles, empty containers and bulk goods can take place around Northport at a fraction of the cost possible in Auckland,” the working group said.

Additionally, the working group pointed out how New Zealand relies mostly on agriculture and forestry to supply exports to provide income for the country. “Of the Upper North Island’s three ports, Tauranga is close to producers of export commodities and is known best as a successful export port, but is also taking an increasing share of Auckland’s import business. Like Tauranga, Northport is also close to producers of export products and also handles the importation of all of New Zealand’s fuel, but its expansion is hampered by the absence of a rail connection.”

Northport features a three-berth facility at Marsden Point with a total wharf length of 570 meters, according to Northport’s website. For berths one and two, there is 13 meters of water available at chart datum and 14.5 meters at berth three.

The port’s terminal primarily focuses on the export of forest products, although it can cater to large, multi-purpose vessels. The port features 58 hectares of land, 30 hectares of which are currently paved and being used for cargo operations, while there is over 180 hectares of land outside the port that is available for port-related ventures to set up and operate from.

Meanwhile, container volumes over at the Port of Tauranga are booming, as well as substantial upgrades at the port.

“International experts have told us that Port of Tauranga can easily accommodate up to 2.8 million TEUs on our current footprint. We already have the next stage of capacity expansion under way,” Port of Tauranga CEO Mark Cairns said in December. “We still have plenty of capacity on the rail connection between Tauranga and Auckland, with the ability to double the current number of trains per day.”

A Port of Tauranga spokesperson told BlueWater Reporting in January that the port owns 190 hectares of land on both sides of Tauranga Harbor, with about 40 hectares still available for development.

“Our next significant capital expenditure will be extending the container terminal quay to the south. Port-owned land adjacent to the existing berths will be converted from cargo storage to a fourth container vessel berth, adding up to 385 meters to the overall quay length. We hope to have this completed in about two years,” the spokesperson added.

The port’s ninth ship-to-shore crane is being delivered in early 2020 as well as seven straddle carriers.

“Future stages of expansion will be driven by cargo volume growth and will primarily involve rail-mounted stacking cranes and additional ship-to-shore cranes,” the spokesperson said.

Ports of Auckland’s perks. Although business at the Ports of Auckland did decline in FY 2019, it still plays a huge role in New Zealand trade, and upgrades at the key port remain underway.

Current projects in the works include automation at the container terminal, as well as a car handling facility.

Beginning in 2020, the container terminal will become the first in New Zealand to use automated straddle carriers to load and unload trucks and operate the container yard, according to a Ports of Auckland FAQ pamphlet updated in January. There will be a total of 27 automated straddles, although the terminal will retain 24 manual straddles for servicing the vessel cranes and the out of gauge, oversized cargo truck lanes. The northern berth will be automated first in late March 2020, while the launch of phase two is expected to occur in May, in which automated straddles will work the southern half of the terminal.

Meanwhile, the Ports of Auckland reiterated in its December 2019 quarterly newsletter that its car handling facility will be complete by August 2020. The facility will allow the port to handle more cars in less space and will be capable of holding up to 1,700 vehicles.

Additionally, the Ports of Auckland does still appear to economically benefit Auckland and New Zealand as a whole. The consulting firm New Zealand Institute of Economic Research (NZIER) released a report in October 2019, dubbed, “Location, location, location – The value of having a port in the neighbourhood,” which found that the national economy, measured by GDP, would be well over NZ$1 billion smaller per year if goods moved through another port.

NZIER noted how the value of cargo crossing the wharfs at the port has grown faster than the volume, especially on the import side, as well as how the downtown port serves the country’s largest and fastest growing center of economic activity.

The port “gives firms in Auckland a competitive advantage: the final leg of an import journey is a short one, as is the first leg of an export journey,” NZIER said.

Additionally, data from BlueWater Reporting’s Country to Country Transit Analysis by Service tool shows how the Ports of Auckland plays a key role in liner shipping operations from China, New Zealand’s top trading partner, in terms of imports and exports.

The first chart below shows that four of the five fastest liner shipping transits from China to New Zealand involve Auckland. However, the second chart below shows that from New Zealand to China, the fastest transits involve the Port of Tauranga, followed by the ports of Napier and Lyttelton.

Source: Bluewater Reporting

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.info/pt-PT/register?ref=KDN7HDOR